Get 20101040nr Ez Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 20101040nr Ez Form online

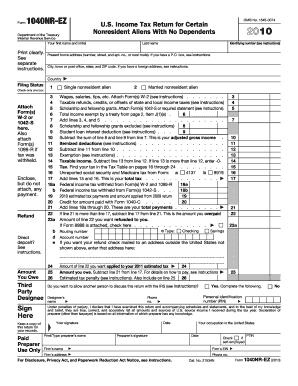

Filling out the 20101040nr Ez Form online is a straightforward process designed to assist nonresident aliens with no dependents in filing their U.S. income tax return. This guide provides clear, step-by-step instructions to ensure that users complete the form accurately.

Follow the steps to successfully complete your 20101040nr Ez Form online.

- Click the ‘Get Form’ button to acquire the form and access it in your online document management interface.

- Begin filling out the form with your personal information. Include your first name, middle initial, last name, and identifying number.

- Enter your present home address, including the street number, apartment number (if applicable), city, state, ZIP code, and country.

- Select your filing status by checking the appropriate box for single or married nonresident alien.

- Attach relevant forms, such as W-2 or 1042-S, as instructed. Ensure you follow the guidelines for attaching these documents.

- Input your wages, salaries, tips, and other income sources, including scholarship and fellowship grants, as required.

- Calculate your adjusted gross income by following the prescribed steps, ensuring you account for any deductions or exemptions.

- Determine your total tax liability based on the adjusted gross income and include any unreported taxes.

- Complete the payment section, detailing any federal income tax withheld and any applicable estimated tax payments.

- If applicable, indicate whether you wish to allow another individual to discuss this return with the IRS by filling out the associated fields.

- Review all entered information for completeness and accuracy to prevent discrepancies.

- Once satisfied with the information provided, save your changes, then download or print the form for your records.

Start completing your 20101040nr Ez Form online today for a smooth filing experience.

You must file Form 1040-NR if you are not a U.S. citizen and earned income from U.S. sources. This includes foreign nationals, students, and certain business visitors who meet specific criteria. Understanding these requirements for the 20101040nr Ez Form is crucial, as failing to file can lead to penalties or other complications. The USLegalForms platform provides guidance to help you determine your filing obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.