Loading

Get Form 4768 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4768 2008 online

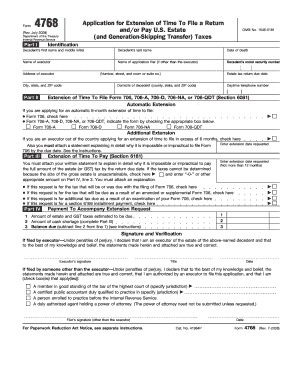

Filling out Form 4768, the Application for Extension of Time To File a Return and/or Pay U.S. Estate Taxes, online can seem daunting. This guide provides a clear and supportive walkthrough to help users complete the form accurately and efficiently.

Follow the steps to successfully complete Form 4768 online.

- Click ‘Get Form’ button to obtain the form and open it in the form editor.

- Complete Part I: Identification. Input the decedent’s first name, middle initial, last name, date of death, and social security number. Add the executor’s name and address, including city, state, and ZIP code. Specify the estate tax return due date and the decedent's domicile with ZIP code, followed by the daytime telephone number.

- Proceed to Part II: Extension of Time To File. Indicate if you are applying for an automatic 6-month extension by checking the appropriate box for Form 706 or other specified forms. If you need an additional extension due to being out of the country, check the corresponding box and ensure to attach a detailed explanation.

- Move to Part III: Extension of Time To Pay. Here, you must include a written statement explaining why it is impossible or impractical to pay the full tax amount by the due date. If the gross estate size is unascertainable, check the relevant box and enter an appropriate amount on the lines provided.

- In Part IV, enter the requested extension date. Ensure this does not exceed 12 months. Specify if the extension request is related to the due tax from the filing of Form 706 or due to amendments, examinations, or installment payments.

- Provide the estimated amounts in Part IV for the estate taxes, cash shortage, and balance due. Carefully calculate the figures to ensure accuracy.

- Complete the Signature and Verification section according to your capacity—either as the executor or authorized person. Make sure to sign and date the form, affirming the statements provided are true and accurate.

- Finally, review all entries to ensure completeness and correctness. Once satisfied, save your changes, download the form, and print or share it as needed.

Begin filing your Form 4768 online today to ensure timely compliance with tax regulations.

The deadline for filing Form 3520 is typically the 15th day of the fourth month following the end of the tax year. If you need additional time, file Form 4768 2008 for an extension. Being aware of these deadlines is crucial for compliance. Referencing resources from USLegalForms can help you maintain these important dates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.