Loading

Get Irs Form 8582 For 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 8582 for 2010 online

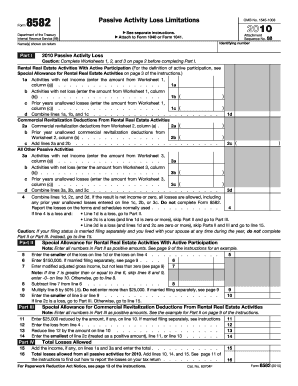

Filling out the IRS Form 8582 for 2010 can be an essential step for taxpayers reporting passive activity losses. This guide will provide you with clear, step-by-step instructions to help you complete the form online effectively.

Follow the steps to accurately complete your IRS Form 8582.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the identifying number and the names shown on your return at the top of the form.

- Move to Part I and refer to Worksheets 1, 2, and 3 on page 2 to gather necessary information regarding your rental real estate activities.

- For line 1a, enter the net income from Worksheet 1, column (a). For line 1b, enter the activities with net loss from Worksheet 1, column (b), and for line 1c, input the prior years' unallowed losses from column (c).

- Combine the amounts on lines 1a, 1b, and 1c for line 1d.

- Continue with lines 2a, 2b, and 2c, entering commercial revitalization deductions from Worksheets 2.

- Proceed to lines 3a, 3b, and 3c, inputting information from Worksheet 3 regarding all other passive activities.

- Combine the totals from lines 1d, 2c, and 3d, and assess if the result is a net income or zero. If it is, you can skip to the normal reporting forms.

- If line 4 indicates a loss, follow the instructions given based on specific conditions outlined in the form.

- Complete Parts II, III, and IV as applicable, ensuring all entries are positive amounts wherever indicated.

- After filling out all relevant sections, review your entries thoroughly for accuracy.

- You can then save your changes, download, print, or share the completed form as needed.

Start filling out your IRS Form 8582 online today!

A taxpayer can carry back passive activity losses for up to two years. Using the IRS Form 8582 for 2010, you can adjust your calculations to reflect these losses on previous tax returns. This allows you to potentially offset income from earlier years, which could lead to a tax refund. It’s wise to consult with a tax professional for guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.