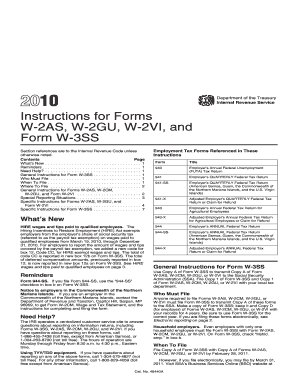

Get 2010 Instruction W-2as, Gu, Vi, W-3ss. Instructions For Forms W-2as, W-2gu, W-2vi, And Form W-3ss

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2010 Instruction W-2AS, GU, VI, W-3SS. Instructions For Forms W-2AS, W-2GU, W-2VI, And Form W-3SS online

Filling out the 2010 Instruction W-2AS, GU, VI, and W-3SS can be straightforward with the right guidance. This user-friendly guide provides step-by-step instructions to help you accurately complete these forms while ensuring compliance with the relevant regulations.

Follow the steps to fill out the forms correctly.

- Press the ‘Get Form’ button to access the document and open it in the editor.

- Begin with Form W-3SS, entering your employer identification number (EIN) in box e. Ensure this matches the EIN used on your previous tax forms.

- In box a, you may enter a control number to keep track of your forms if desired.

- For the total number of Forms W-2AS, W-2GU, or W-2VI being submitted, complete box c accurately.

- Enter the totals reported in boxes 1 through 7 from your Forms W-2 on Form W-3SS.

- Check the appropriate boxes in Box b indicating the type of payer, ensuring only one is selected unless marking ‘Third-party sick pay’.

- Make sure to date and sign the form in the designated area, using original signatures where necessary.

- Review all entries for accuracy and completeness before submission.

- After completing the form, you can save changes, download, print, or share the document as necessary.

Get started on your document and ensure timely and accurate submission!

Yes, you can often access your W-2 form online through your employer's payroll system or HR portal. Many companies provide digital copies of W-2s for convenience and quicker access. If your employer does not offer this option, you may need to request a physical copy. For assistance, you can explore resources like uslegalforms, which can guide you in obtaining your W-2 forms. Be sure to refer to the 2010 Instruction W-2AS, GU, VI, W-3SS. Instructions For Forms W-2AS, W-2GU, W-2VI, And Form W-3SS for further clarity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.