Get Department Of The Treasury Advanced Earned Income Poster Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Department Of The Treasury Advanced Earned Income Poster Form online

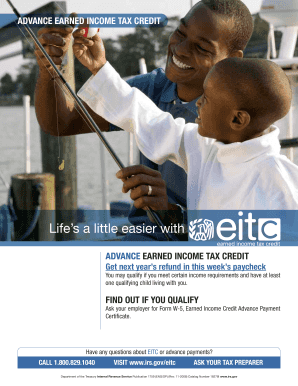

The Department Of The Treasury Advanced Earned Income Poster Form is an essential document for individuals seeking to understand their eligibility for the advance earned income tax credit. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to access the document and open it in your preferred digital workspace.

- Review the introductory section of the form, which outlines the criteria for eligibility for the advance earned income tax credit. Ensure you understand the income requirements and qualifying child stipulations.

- Locate the section where you will input your personal information, such as your name, address, and Social Security number. Double-check this information for accuracy as it is critical for processing.

- Fill in the details regarding your qualifying child. You will need to provide their name, date of birth, and Social Security number. It is important that this information matches official records.

- Complete the income section, where you will report your income for the previous tax year. This may require you to refer to your financial records to ensure accurate reporting.

- Review the completed form for any errors or omissions. It is advisable to have a second set of eyes review your submissions if possible to ensure everything is accurate.

- Once you have verified all information is correct, proceed to save your changes. You can then download, print, or share the completed form according to your needs.

Start filling out the Department Of The Treasury Advanced Earned Income Poster Form online to secure your potential refunds.

You may receive a letter about the Earned Income Credit due to a discrepancy or verification request from the IRS. This letter may ask for additional information to confirm your eligibility for the credit. It’s advisable to consult the Department Of The Treasury Advanced Earned Income Poster Form for guidance on how to respond. Handling this promptly can help secure your entitled benefits and prevent delays in processing your tax return.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.