Get 1098 C Instructions Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1098 C Instructions Form online

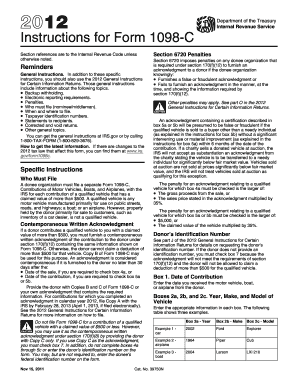

Filling out the 1098 C Instructions Form is a crucial step for donee organizations when reporting contributions of motor vehicles, boats, and airplanes. This guide will help users navigate each section of the form easily and effectively, ensuring compliance with IRS requirements.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Enter the date you received the motor vehicle, boat, or airplane from the donor in Box 1.

- In Boxes 2a, 2b, and 2c, fill in the year, make, and model of the vehicle respectively.

- Provide the vehicle or other identification number in Box 3, typically found in the vehicle owner’s manual.

- If applicable, check Box 5b to indicate the vehicle will be transferred to a needy individual for significantly below fair market value.

- If sold to an unrelated party, check Box 4a and complete 4b and 4c. Enter the date of sale in Box 4b and the gross proceeds in Box 4c.

- If you provided goods and services in exchange for the vehicle, indicate this by checking Box 6a, and complete Box 6b with an estimated value.

- Provide a detailed description of the goods and services provided in Box 6c.

- If the claimed value of the vehicle is $500 or less, check Box 7 and skip filing Copy A with the IRS.

- After completing all necessary fields, save your changes, and options to download, print, or share the form will be available.

Start completing your 1098 C Instructions Form online today for accurate and efficient reporting.

If you don't have a 1098 mortgage interest statement, you may still report your mortgage interest payments on your tax return. However, the IRS expects you to maintain proper documentation, such as bank statements or payment schedules. Without the 1098 C Instructions Form, you risk a delay during tax filing. To simplify this, consider using platforms like uslegalforms, which offer guidance on how to manage such situations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.