Loading

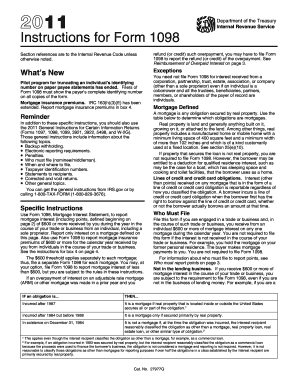

Get 2011 Mortgage Interest Statement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Mortgage Interest Statement Form online

Filling out the 2011 Mortgage Interest Statement Form can seem daunting, but with a clear step-by-step approach, you can complete it accurately. This guide will walk you through each section of the form to ensure you understand how to fill it out effectively and file it online.

Follow the steps to complete the 2011 Mortgage Interest Statement Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out Box 1, where you will report the mortgage interest received from the payer during the calendar year. Ensure that you only include the actual interest received, excluding any points.

- Proceed to Box 2 to report any points paid on the purchase of the payer's principal residence. Points are fees that some lenders may charge to reduce the interest rate.

- In Box 3, enter any refunds of overpaid interest from prior years, if applicable. This should be reported only if it amounts to $600 or more.

- For Box 4, report total mortgage insurance premiums received that are $600 or more during the year. This includes premiums for qualified mortgage insurance.

- Fill in the necessary information for the recipient's name, address, and telephone number in the designated box. Ensure this information matches the details you will provide on Form 1096.

- Provide the payer's name and address in the appropriate boxes, being careful to ensure that the information is correctly entered.

- If applicable, enter any additional information in Box 5, such as the property address or other relevant items. This box is optional and does not need to be reported to the IRS.

- Finally, review all entered information for accuracy, then save changes, download, or print the completed form for submission.

Start completing your 2011 Mortgage Interest Statement Form online today!

Yes, you can claim mortgage interest on your income tax return if you meet certain criteria. The mortgage interest must be for your primary or secondary residence, and you should have received a 2011 Mortgage Interest Statement Form from your lender. It's essential to follow IRS guidelines to ensure your claim is valid. If needed, use tax software to help you with the deduction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.