Loading

Get Form W-10 (rev. July 2011 ) - Internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-10 (Rev. July 2011) - Internal Revenue Service online

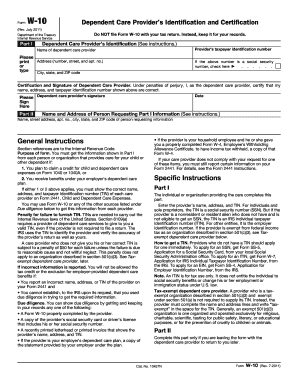

Filling out Form W-10 (Rev. July 2011) is essential for obtaining the necessary information from dependent care providers. This guide will provide you with a clear, step-by-step approach to effectively complete the form online.

Follow the steps to successfully fill out Form W-10.

- Click ‘Get Form’ button to access the form and open it for editing. This will allow you to begin completing the necessary fields.

- In Part I, provide the dependent care provider’s identification details. Enter the provider’s taxpayer identification number, name, and address. Ensure all information is entered accurately.

- If the provider’s taxpayer identification number is a social security number, check the appropriate box. Then, the dependent care provider must sign the form to certify the accuracy of the provided information.

- In Part II, if you are leaving the form with the provider to return later, complete this section with your name and address where you want the information sent. Ensure all details are clear and correct.

- Once all sections are complete, review the form for accuracy. After confirming that everything is filled correctly, you can save changes, download, print, or share the completed form as needed.

Start filling out your forms online today to ensure a smooth process!

While the query about Windows 10 does not relate directly to Form W-10 (Rev. July 2011) - Internal Revenue Service, it's helpful to know that Windows 10 operates using a graphical interface allowing users to interact through icons and touch. This system integrates various tools and features to improve user experience. For any legal forms pertaining to technology taxes, platforms like USLegalForms can provide the necessary documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.