Loading

Get La Forma 13844

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the La Forma 13844 online

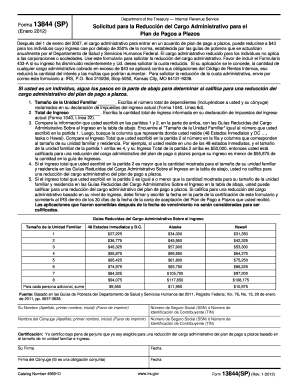

La Forma 13844 is a request form for a reduction of the administrative fee for the installment payment plan. This guide will assist you through the steps needed to complete this form online effectively, ensuring you have all the necessary information to submit your request.

Follow the steps to complete your request for a reduction in the administrative fee.

- Click the 'Get Form' button to obtain the form and open it for editing.

- In the section for family unit size, enter the total number of dependents, including yourself and your partner, as listed on your current income tax return (Form 1040, Line 6d).

- Next, in the total income section, input the total income amount reported on your current income tax return (Form 1040, Line 22).

- Compare the numbers you entered in Steps 1 and 2 against the Reduced Administrative Fee Guidelines provided in the table. Match your entered family unit size from Step 1 with the income thresholds in the table to determine your eligibility.

- If your total income from Step 2 is greater than the amount indicated for your family unit size and state of residence in the guidelines, you will not qualify for a reduction in the administrative fee.

- If your total income is equal to or less than the amount shown for your family unit size and residence based on the guidelines, you may be eligible for the reduction. You will need to sign and date the certification section of the form.

- Submit the completed form to the IRS within 30 days of receiving your acceptance letter for the payment plan to ensure your application is considered.

- Once you have filled in all sections, you can save changes, download, print, or share the finished form as needed.

Complete your La Forma 13844 online today for a smoother payment plan experience.

Gross earnings encompass your total income before any deductions are applied. This includes wages, overtime, bonuses, and additional income sources like freelance work. Understanding what counts in your gross earnings will help you accurately complete La Forma 13844.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.