Loading

Get When Was Irs Form 8874 A 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the When Was Irs Form 8874 A 2004 online

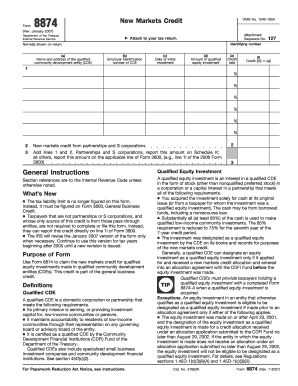

Filling out IRS Form 8874 is essential for claiming the new markets credit for qualified equity investments in community development entities. This guide will provide clear instructions to help users navigate the form online with ease.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section (a), provide the name and address of the qualified community development entity (CDE) related to your investment.

- In the 'Identifying number' field, enter the Employer Identification Number (EIN) of the CDE.

- For (c), fill in the date of your initial investment.

- In (d), enter the amount of your qualified equity investment.

- For (e), specify the credit rate; if it's the first three years, enter ‘5’ and ‘6’ for any subsequent years.

- Calculate the credit amount in (f) by multiplying the investment amount by the credit rate.

- If applicable, add the new markets credit from partnerships and S corporations in section 2.

- Review all entries to ensure accuracy, then save changes, download, print, or share the completed form as needed.

Complete your IRS Form 8874 online today for efficient processing.

To view IRS forms, you can visit the official IRS website where forms are available for download. The site offers a user-friendly search function to help you locate the specific form or publication you need. Additionally, platforms like US Legal Forms provide access to fillable IRS forms and guidance on their use. Leveraging these resources can streamline your filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.