Loading

Get 8865 Form 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8865 Form 2011 online

This guide provides clear, step-by-step instructions on completing the 8865 Form 2011, designed for users with varying levels of legal experience. Follow these instructions to ensure your form is filled out accurately and effectively.

Follow the steps to complete the 8865 Form 2011 successfully.

- Press the ‘Get Form’ button to obtain the form and open it in the designated editor.

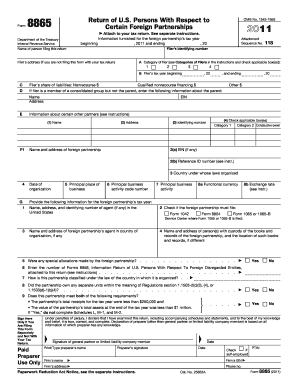

- Begin by entering the relevant filer information in Section A, ensuring the correct Category of filer is checked. Make sure to enter your address if you are not filing this form with your tax return.

- Complete Section B, which asks for your tax year and details regarding liabilities. Make sure to provide accurate financial figures.

- In Section C, provide your identifying number and details about the person filing the return. If applicable, provide your employer identification number (EIN).

- Fill out the information regarding the foreign partnership in Section D. This includes its name, address, and identifying number.

- Proceed to the income details, which can be filled in under separate schedules A, B, and C. Document all necessary information regarding income and expenses.

- Make sure to complete Schedule K to denote the partners' distributive share items, including ordinary business income and capital gains.

- Review the balance sheets and complete any required information in Schedules L, M, N, and any other relevant sections.

- Once you have filled out all sections and schedules, carefully review the completed form for accuracy.

- Finally, you have options to save changes, download the completed form, print it, or share it as needed.

Complete your 8865 Form 2011 online today for a streamlined filing experience.

The 8865 Form 2011 is a tax document required for U.S. persons who invest in foreign partnerships. It captures various details about the partnership, such as financial interests and transactions. Completing the form accurately is crucial for complying with IRS regulations and avoiding potential penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.