Loading

Get 2011 Form 8858

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form 8858 online

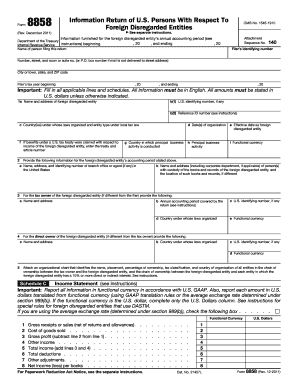

Filling out the 2011 Form 8858 is essential for U.S. persons reporting on foreign disregarded entities. This guide provides clear, step-by-step instructions to help users complete the form online efficiently and accurately.

Follow the steps to fill out the 2011 Form 8858 online.

- Click 'Get Form' button to access the form and open it in the document editor.

- Enter the identifying information of the person filing this return in the designated fields, including your name, address, and tax identification number.

- Provide the relevant details of the foreign disregarded entity in section 1, including its name, address, and the country under whose laws it is organized.

- In section 2, supply information about the accounting period for the foreign disregarded entity, including the effective date and principal business activity.

- Complete sections 3 and 4 with information about the tax owner and direct owner of the foreign disregarded entity, if applicable. Include their names, addresses, identifying numbers, and currencies used.

- Attach an organizational chart in section 5 if required, detailing the ownership structure relating to the foreign disregarded entity.

- Fill out Schedule C, providing the income statement and reporting all amounts in functional currency. Include gross receipts, cost of goods sold, and net income.

- Complete Schedule F by reporting the balance sheet information, ensuring amounts are correctly computed in U.S. dollars.

- In Schedule G, respond to questions regarding interests in trusts and partnerships owned by the foreign disregarded entity.

- Finalize by reviewing all sections for accuracy and completeness, making sure all information is in English and amounts are in U.S. dollars.

- Once all information is accurately filled out, proceed to save changes, download, print, or share the completed form as needed.

Ensure compliance by completing your Form 8858 online today.

Yes, you can file your tax return from abroad, including the 2011 Form 8858, as long as you have access to the necessary forms and information. The IRS allows U.S. taxpayers living outside the country to file electronically or via mail. Utilizing services like US Legal Forms can facilitate this process, ensuring that you meet all deadlines while residing internationally.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.