Loading

Get Form 8849 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8849 Instructions online

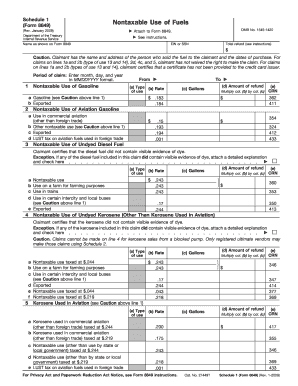

This guide provides clear, step-by-step instructions on how to complete the Form 8849 Instructions online. Understanding the components of the form and how to accurately fill it out is essential for ensuring a successful claim for a refund on nontaxable fuel use.

Follow the steps to complete the Form 8849 Instructions online effectively.

- Press the ‘Get Form’ button to access the form and open it in your editing tool.

- In the first section, enter your name as shown on Form 8849 and your Employer Identification Number (EIN) or Social Security Number (SSN). Make sure the details are accurate.

- Indicate the total refund amount by adding all refund amounts you calculated in subsequent sections.

- For each nontaxable fuel type, fill in the appropriate fields: specify the type and rate of use, the amount in gallons, and calculate the refund by multiplying the rate by the gallons used.

- Ensure you complete the fields for nontaxable diesel fuel, kerosene, and other alternative fuels, following the instructions for allowable uses to maximize accuracy.

- Review all entries for correctness to ensure compliance with the Form 8849 Instructions. Pay special attention to any required supporting documents.

- Once all fields are accurately completed, save your changes, then download, print, or share the form as needed, ensuring a record of your submission.

Start completing your Form 8849 Instructions online today to secure your refund.

An 8849 refers to Form 8849, which is essential for claiming refunds on certain excise taxes. This form allows for a precise accounting of the taxes you have overpaid. To effectively navigate the complexities of this form, be sure to consult the Form 8849 Instructions for insights on how to properly complete it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.