Loading

Get Irs 8654 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs 8654 Form online

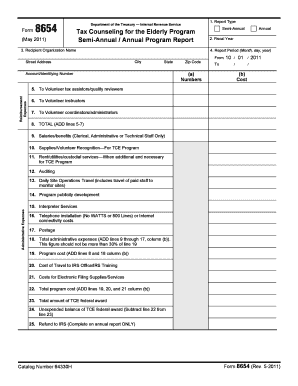

The Irs 8654 Form is essential for organizations participating in the Tax Counseling for the Elderly Program. This guide will provide you with a straightforward, step-by-step process for completing the form online, ensuring that you can accurately report your program's activities and expenses.

Follow the steps to fill out the Irs 8654 Form online effectively.

- Click the ‘Get Form’ button to obtain the Irs 8654 Form and open it in your editing tool.

- Enter the report type by marking the appropriate box for either a semi-annual or annual report.

- Input the fiscal year for which the report is being prepared.

- Fill in the recipient organization name, street address, city, state, and zip code as well as the account/identifying number, which is your Employer Identification Number (EIN).

- Specify the report period by entering the month, day, and year in the respective fields.

- Provide the number of volunteer tax assistors/quality reviewers in line 5(a), volunteer instructors in line 6(a), and volunteer coordinators/administrators in line 7(a). Calculate the total on line 8(a).

- In column (b), state the reimbursement expenses for each of the volunteer roles, ensuring not to duplicate any expenses.

- Document the salaries and benefits for clerical, administrative, or technical staff on line 9.

- List the costs associated with supplies for the TCE program on line 10.

- Record rent, utilities, and custodial service costs in line 11, if applicable.

- Account for auditing costs on line 12.

- Enter the daily site operations travel costs in line 13.

- Provide the publicity development costs in line 14.

- Indicate any expenses for interpreter services on line 15.

- List the telephone installation or internet connectivity costs on line 16.

- Document total postage expenses on line 17.

- Calculate total administrative expenses in line 18 by adding lines 9 through 17.

- Calculate total program costs in line 19 by summing lines 8 and 18.

- Record any travel costs to the IRS office or for IRS training on line 20.

- Specify costs for electronic filing supplies and services in line 21.

- Calculate the overall program costs in line 22 by adding lines 19, 20, and 21.

- Enter the total amount of the TCE federal award on line 23.

- Calculate the unexpended balance of the TCE federal award by subtracting line 22 from line 23 on line 24.

- Complete line 25 for any refunds to the IRS only if applicable to the annual report.

- Provide the number of individual federal tax returns prepared (paper and electronic) in lines 26, 27, and 28.

- Document the number of taxpayers assisted in lines 29 and 30.

- Indicate the number of tax preparation sites in line 31.

- Attach a listing of each site’s SIDN and EFIN, along with the volunteer preparation hours, as instructed in line 32.

- Ensure that all entries are cumulative to reflect expenditures for the entire reporting period.

Start filling out your Irs 8654 Form online today to ensure accurate reporting for your program.

The fastest way to get an IRS form is by visiting the IRS official website. There, you can search for forms such as the IRS 8654 Form and download them immediately. Remember, this online approach is quick and efficient, allowing you to skip any waiting times.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.