Get Form 8498 Online Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8498 Online Application online

This guide provides a comprehensive overview of the Form 8498 Online Application, assisting users in accurately completing the application for becoming an approved continuing education provider. By following these step-by-step instructions, users can ensure their submissions meet all necessary requirements.

Follow the steps to complete your application effectively.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

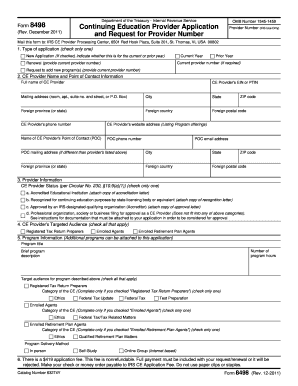

- Identify the type of application by checking one option: 'New Application', 'Renewal', or 'Request to add new program(s)'. If you are submitting a new application or renewal, provide the current provider number where required.

- Enter the continuing education provider's name and the point of contact information, including the provider's EIN or PTIN, mailing address, phone number, and email address.

- Select the CE provider status by checking the appropriate box: accredited educational institution, recognized by a state licensing body, approved by an IRS-designated accreditor, or professional organization submitting for approval.

- Check all applicable targeted audiences for your continuing education programs, such as registered tax return preparers or enrolled agents.

- Provide details for each program offered, including the program title, number of hours, description, targeted audience, and category of continuing education.

- Indicate the program delivery method, choosing from options like in-person, self-study, or online group.

- Prepare your payment of $419 for the application fee, ensuring it is included with your submission as it is non-refundable.

- Review the entire application for accuracy and completeness, then save your changes, download a copy, print, or share the form as needed.

Complete your Form 8498 Online Application today to become an approved continuing education provider.

Form 8498 is an essential document for your tax reporting needs, particularly for those involved in certain investment transactions. This form helps detail the qualifications for tax deductions or credits related to investments. Completing the Form 8498 Online Application gives you a clear view of your reporting obligations and is a great way to stay organized. Ensure that you understand its impact on your overall tax situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.