Loading

Get Form 8388

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8388 online

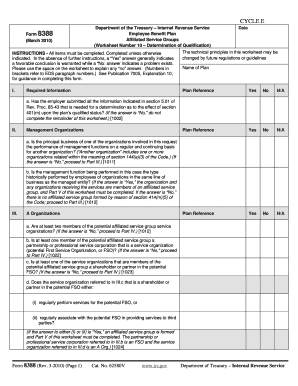

This guide will assist you in successfully completing Form 8388, which is used for employee benefit plan determinations involving affiliated service groups. The following steps will lead you through each section of the form, ensuring a smooth online filing experience.

Follow the steps to fill out the Form 8388 online effectively.

- Press the ‘Get Form’ button to acquire the form and launch it in your preferred editing tool.

- Begin with the 'Plan Reference' section, marking ‘Yes’, ‘No’, or ‘N/A’ as suitable. Ensure you include any relevant explanations for ‘No’ answers in the designated space.

- In the 'Required Information' section, provide the name of the plan. Confirm whether the employer has submitted all necessary information for a determination regarding the plan’s qualified status, according to section 5.01 of Rev. Proc. 85-43. If the answer is ‘No,’ do not continue with the remainder of the worksheet.

- Proceed to the 'Management Organizations' section and answer the questions provided. If prompted to continue based on previous responses (e.g., ‘Yes’), ensure the next relevant sections are addressed based on your answers.

- Move on to 'A Organizations' and the 'B Organizations' sections. Here, respond to the applicable yes/no questions to identify membership and functional relationships within the affiliated service groups.

- In the 'Qualification Requirements' section, include confirmations for the definitions of 'employer' and whether the plan meets specific requirements under various sections, following the same yes/no format.

- Review all entries for accuracy and completeness before finalizing your document. Upon completion, you can save your changes, download the form, print it, or share it as needed.

Complete your Form 8388 online today to ensure compliance and efficiency in managing your employee benefit plans.

Yes, U.S. residents and citizens are required to declare their foreign property on their tax returns. This includes reporting any income generated from these properties. Compliance with this requirement is crucial to avoid penalties. If you have related questions, consulting with experts who are familiar with Form 8388 may provide valuable insights.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.