Loading

Get 5405 2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 5405 2011 Form online

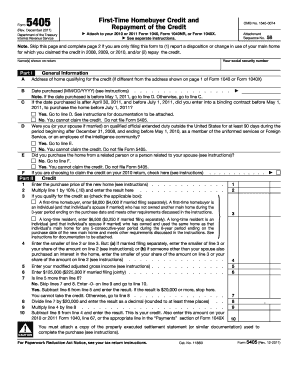

Filling out the 5405 2011 Form can seem daunting, but this guide will break down each section to assist you in completing it online. This form is essential for individuals claiming the first-time homebuyer credit or repaying it, ensuring that you have the necessary information in mind as you navigate through the process.

Follow the steps to easily complete the 5405 2011 Form online.

- Click ‘Get Form’ button to obtain the 5405 2011 Form and open it in a digital format for editing.

- Begin by filling out your social security number and the names shown on your tax return at the top of the form.

- In Part I, provide the address of the home that qualifies for the credit, if it differs from your return. Specify the date of purchase in the required format (MM/DD/YYYY).

- Follow the instructions regarding your eligibility for the credit. If your purchase qualifies based on the date, proceed to the next questions to complete your eligibility assessment.

- In Part II, enter the purchase price of your new home. Then calculate 10% of this amount and document it in the specified field.

- Indicate if you are a first-time homebuyer or a long-time resident to determine the appropriate credit amount. Enter this value into the designated section.

- Complete the calculations outlined in the credit section, including modified adjusted gross income and determining if your income exceeds the set thresholds.

- For Part III, if applicable, indicate the date you disposed of or ceased using the home that previously qualified for the credit.

- In Part IV, follow the instructions to summarize the repayment necessary if you have disposed of your home.

- Once you complete all relevant sections, review your entries for accuracy before proceeding to save changes.

- Finally, save the form digitally, then choose to download it, print it, or share it as needed for your records.

Start completing your documents online for a streamlined filing experience.

Yes, you may need to repay the First-Time Homebuyer Credit if you violate the repayment terms, such as selling your home within the required period. In this case, you would file the 5405 2011 Form to report the repayment to the IRS. It's crucial to keep track of your obligations to avoid unexpected penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.