Get Section 619 Of Revenue Procedure 2008 6 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Section 619 Of Revenue Procedure 2008 6 Form online

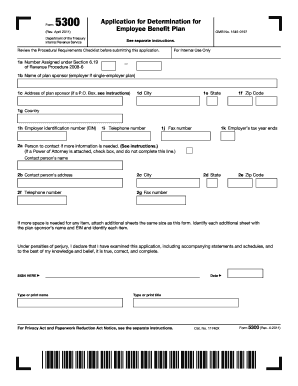

The Section 619 Of Revenue Procedure 2008 6 Form is essential for applying for determination of employee benefit plans. This guide provides a clear, step-by-step approach to completing the form online, ensuring that users with varying levels of experience can navigate the process effectively.

Follow the steps to successfully complete the form online:

- Press the ‘Get Form’ button to access the Section 619 Of Revenue Procedure 2008 6 Form and open it in your designated web browser or application.

- Fill in section 1a by entering the number assigned under Section 6.19 of Revenue Procedure 2008-6 for internal use.

- Complete section 1b with the name of the plan sponsor, which can be the employer in cases of single-employer plans.

- Provide the address details of the plan sponsor in sections 1c through 1g, including city, state, zip code, and country.

- Enter the employer identification number in section 1h.

- Input the telephone number and fax number of the plan sponsor in sections 1i and 1j, respectively.

- Indicate the employer’s tax year ends in section 1k.

- In section 2a, provide the name of the contact person for further inquiries, if applicable.

- Fill in the contact person's address in section 2b and ensure that all fields in section 2c through 2g are completed.

- Review sections 3a through 14 to answer questions related to the determination request, plan details, eligibility requirements, and miscellaneous information.

- Double-check each completed section for accuracy and completeness.

- Once all sections are filled out, save the changes made to the form. You may have options to download, print, or share the completed form as needed.

Begin completing your Section 619 Of Revenue Procedure 2008 6 Form online today to ensure a smooth application process.

Yes, if you are an NRI and your income exceeds the basic exemption limit in India, you are required to file an Income Tax Return (ITR). This applies even if your income is generated outside India. Adhering to the guidelines of Section 619 of Revenue Procedure 2008 6 Form ensures you are compliant with Indian tax regulations while residing abroad.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.