Loading

Get Form 4952 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4952 2011 online

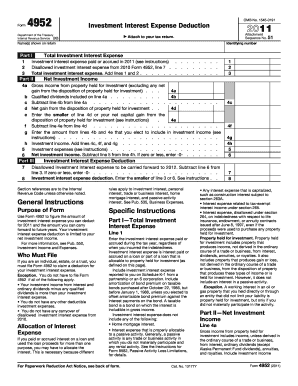

Form 4952 is essential for individuals, estates, or trusts looking to claim a deduction for investment interest expenses. This guide provides clear, step-by-step instructions on how to complete this form online, ensuring users have the necessary information to maximize their tax deductions.

Follow the steps to fill out Form 4952 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter the total investment interest expense paid or accrued in 2011. This includes interest on loans associated with property held for investment. Make sure to add any disallowed investment interest expense from 2010, as indicated.

- Proceed to Part II, where you will need to calculate your net investment income. Start by filling in the gross income from property held for investment, excluding any gains from the sale of such property. Make sure to itemize any qualified dividends as well.

- For Line 4d, account for any net gain from the disposition of property held for investment, ensuring you follow the instructions provided to accurately determine this amount.

- On Line 5, report any investment expenses that are legally deductible. These expenses should directly relate to the production of investment income, excluding any passive activity deductions.

- In Part III, use the net investment income to determine your investment interest expense deduction. Enter the smaller of the total investment interest expense from Part I or the net investment income calculated in Part II.

- Finally, review all your entries for accuracy. Once you are satisfied with your completed form, save the changes, and choose to download, print, or share the form as needed.

Complete your tax documents online for a seamless filing experience.

Yes, you may need various tax forms for your investment account depending on your transactions. For example, if you have margin interest, you will require Form 4952. If you sell investments, you will need to report gains or losses. Using tools like UsLegalForms can streamline this process, ensuring you stay compliant and organized.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.