Get 2011 Form 4684

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form 4684 online

Filling out the 2011 Form 4684 requires careful attention to detail to accurately report casualties and thefts of personal and business property. This guide provides a comprehensive step-by-step approach to help users complete the form online with confidence.

Follow the steps to successfully complete the 2011 Form 4684.

- Click ‘Get Form’ button to access the form and open it in the online editor.

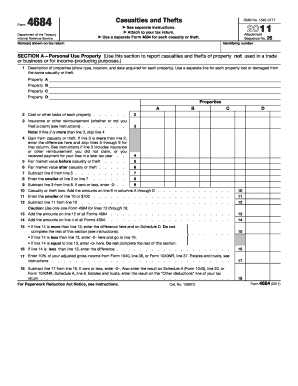

- Identify the section you need, as there are specific parts for personal use property and business/income-producing property. Section A is for personal use property, and Section B consists of parts focused on business or income-producing property.

- In Section A, list each property you are reporting for casualties or thefts. Provide a description including type, location, and date acquired for each property. Use a separate line for each property lost or damaged.

- Enter the cost or other basis of each property in the designated fields. This figure is crucial for determining the loss you can claim.

- Indicate any insurance or other reimbursements you received for the property losses, regardless of whether you filed a claim. If you received reimbursement that is more than your cost basis, skip the calculation of gain from casualty or theft.

- Calculate and enter the fair market value before and after the casualty or theft for each property to assess the financial impact accurately.

- Follow the lines to calculate your total casualty or theft loss by adding the amounts in relevant columns and completing the necessary calculations as outlined.

- In Section B, repeat the detailed property description process for business and income-producing property, ensuring each item is documented and calculated accurately.

- Double-check all entries for accuracy, particularly financial calculations, and ensure that all properties are accounted for through the designated lines.

- Once you have completed the form, you can save your changes, download a copy for your records, print it out, or share it as necessary.

Begin filling out the 2011 Form 4684 online to ensure your casualty and theft losses are reported accurately.

To calculate a casualty loss, assess the decrease in fair market value due to the casualty event. Start with the property's value before the incident, subtract the value after the incident, and consider any insurance reimbursements. This process is crucial when filling the 2011 Form 4684, as accurate calculations ensure you claim the correct amount. Our platform offers resources to simplify this calculation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.