Loading

Get F3520 2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F3520 2011 form online

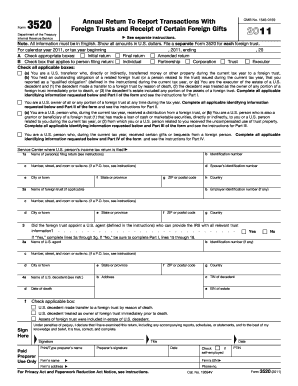

Filling out the F3520 2011 form is an important process for those engaging in transactions with foreign trusts or receiving certain foreign gifts. This guide provides clear and supportive instructions on how to effectively complete this form online.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to access the F3520 2011 form and open it in the editor.

- Begin filling out the form by providing the necessary identification information such as your name, address, and identification number. Ensure all information is accurate.

- Select the appropriate boxes indicating the type of return you are filing (initial, final, or amended) and who is filing the return (individual, partnership, corporation, trust, or executor).

- Complete Part I if you are a U.S. transferor or an owner of a foreign trust. Provide details on the transfer, including date, description, and whether any person will be treated as the owner of the transferred assets.

- If applicable, complete Part II for U.S. owners of a foreign trust by providing information about the foreign trust and any distributions received.

- In Part III, disclose any distributions received from a foreign trust and provide necessary details about each distribution, including amounts.

- For gifts or bequests received from foreign persons, complete Part IV by listing each gift, including dates and fair market values.

- Review all information entered on the form to ensure accuracy and completeness.

- Once finished, save changes, and you have the option to download, print, or share the completed form for your records.

Complete your F3520 2011 form online today to ensure compliance with tax regulations.

The easiest tax form varies based on individual circumstances. However, many find the standard 1040 form more straightforward compared to the F3520 2011 Form, depending on their tax situation. It’s important to choose the form that aligns with your financial activities to ensure clarity and ease when filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.