Loading

Get Form 3115

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3115 online

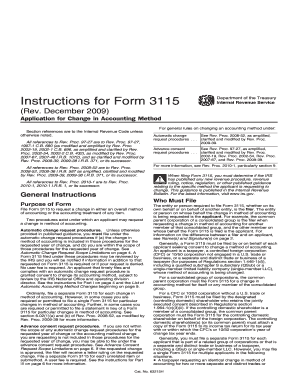

Form 3115 is utilized by taxpayers to request a change in accounting methods. This guide provides comprehensive and user-friendly instructions for completing the form online, ensuring clarity for users with varying levels of experience.

Follow the steps to successfully complete Form 3115 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Read the general instructions for the form carefully. Ensure you understand which change in accounting method you need and whether you fall under automatic or advance consent request procedures.

- Fill out the basic information including the name of the filer, taxpayer identification number, and principal business activity code.

- Indicate the type of accounting method change being requested. Select the appropriate box for depreciation or other relevant coding.

- For automatic changes, complete Parts I, II, and IV. For advance consent requests, complete Parts II, III, and IV, along with relevant schedules such as A, B, C, D, and E.

- Review all entries for accuracy. Ensure that all required documents and attachments are included as per the instructions.

- After reviewing, you can save your changes, download a copy of the completed form, or print it for submission.

- Submit your form to the appropriate IRS office based on whether it is an automatic change or an advance consent request.

Complete your Form 3115 online today to ensure a smooth and efficient accounting method change process.

To file IRS Form 3115, begin by downloading the form and related instructions from the IRS website. Complete the form carefully, making sure to indicate your specific changes in accounting method. Finally, submit it either by mail or electronically, depending on what best suits your needs and compliance requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.