Loading

Get Form F2106 For 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form F2106 For 2011 online

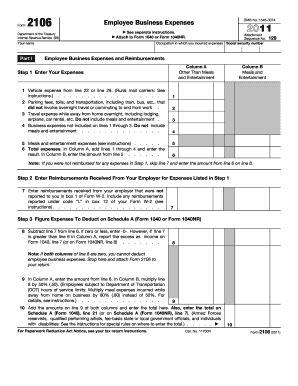

Form F2106 for 2011 is used to report employee business expenses for the tax year. This guide will provide you with clear, step-by-step instructions on how to fill out the form online, ensuring a smooth and accurate submission process.

Follow the steps to complete Form F2106 online.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your name and social security number in the designated fields at the top of the form.

- In Part I, list your occupation in which you incurred the expenses.

- For Step 1, itemize your expenses in Column A. Start by entering your vehicle expenses from the applicable lines, followed by parking fees, travel expenses, and business expenses that do not include meals or entertainment.

- In Column B, enter any meals and entertainment expenses. After filling both columns, calculate the total in Column A by adding the expense lines.

- If you received reimbursements from your employer for the expenses, report those amounts in Step 2.

- In Step 3, calculate the expenses to deduct on Schedule A by subtracting the reimbursement amount from your total in Column A.

- If both total expenses columns result in zero, you cannot deduct employee business expenses. Otherwise, transfer the appropriate amounts to Schedule A.

- Complete Part II by detailing vehicle expenses if applicable, including business use percentages and average miles driven.

- After reviewing the entire form for accuracy, you can save your changes, download it, print, or share the completed form.

Complete your documents online to ensure a timely and accurate filing process.

Filing old Form 941 involves completing the correct form for each missed quarter and submitting it to the IRS. You can find the forms on the IRS website or use tax software for assistance. After submitting, keep an eye on confirmed receipt from the IRS to ensure compliance. Our platform also offers insights on other essential forms, including Form F2106 for 2011, to help you navigate these requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.