Loading

Get Schedule 1041 Alternative Min Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule 1041 Alternative Min Tax Form online

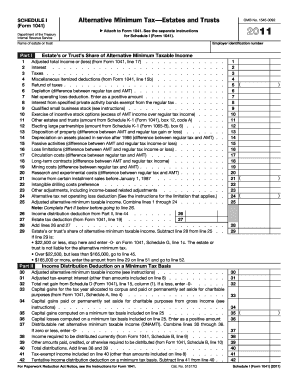

Completing the Schedule 1041 Alternative Minimum Tax Form online ensures that estates and trusts comply with the IRS requirements. This guide provides detailed, step-by-step instructions to help users accurately fill out the form.

Follow the steps to complete the Schedule 1041 Alternative Min Tax Form online.

- Press the ‘Get Form’ button to access the Schedule 1041 Alternative Minimum Tax Form and open it in your preferred online editor.

- Enter the employer identification number in the designated field at the top of the form.

- Provide the estate’s or trust’s share of alternative minimum taxable income in the appropriate section, ensuring accuracy in your figures.

- List any adjusted alternative minimum taxable income and tax-exempt interest required, paying close attention to the instructions for each line item.

- If applicable, report total net gains or any capital gains allocated to charitable purposes, as indicated by the form.

- Complete the calculations for distributable net alternative minimum taxable income, and ensure to report any amounts that are required to be distributed currently.

- Calculate the tentative income distribution deduction based on the provided lines and ensure to input it accurately.

- In Part IV, compute and enter the alternative minimum tax exemption amount, along with the required calculations based on income thresholds.

- Complete the necessary calculations in Part IV regarding the maximum capital gains rates, making sure to gather the correct data from the prior sections.

- Review the completed form for accuracy, then save your changes, download the document, print it, or share it as needed.

Start filling out the Schedule 1041 Alternative Minimum Tax Form online today for accurate and efficient filing.

To figure out the Alternative Minimum Tax, use the Schedule 1041 Alternative Min Tax Form, which contains the necessary calculations. You will tally specific income types and deductions that impact your AMT liability. For clarity and accuracy, consider consulting tax software or a tax professional, as they can guide you through each step.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.