Get 990 Schedule N Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 990 Schedule N Instructions online

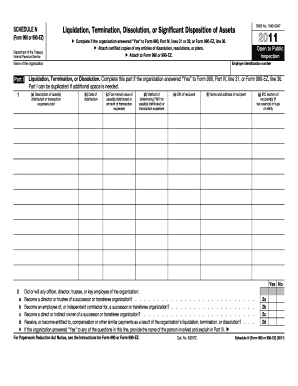

Filling out the 990 Schedule N is essential for organizations reporting their liquidation, termination, or significant disposition of assets. This guide provides clear instructions to assist users in completing the form accurately online.

Follow the steps to complete the 990 Schedule N Instructions online.

- Click ‘Get Form’ button to access the form and open it in your chosen editing tool.

- Begin with Part I, which covers liquidation, termination, or dissolution. If your organization answered 'Yes' to Form 990, Part IV, line 31, enter the description of the assets distributed or transaction expenses paid in column (a).

- Next, enter the date of distribution in column (b) and the fair market value of the distributed assets or transaction expenses paid in column (c).

- In column (d), specify the method used to determine fair market value for the assets distributed or the transaction expenses incurred.

- Fill in columns (e) and (f) with the Employer Identification Number (EIN), name, and address of each recipient of the distributed assets or paid transaction expenses.

- Indicate whether any officer, director, trustee, or key employee will be involved with a successor organization in Part I, line 2.

- Proceed to Part II if your organization answered 'Yes' to Form 990, Part IV, line 32. Repeat similar instructions for listing asset descriptions and transaction expenses.

- Complete Part III if supplementary information is necessary to clarify responses from Parts I and II. Make sure to support any claims with adequate narratives.

- Once all information is entered, ensure to review the form for accuracy. You can save changes, download, print, or share the completed form as needed.

Complete your 990 Schedule N Instructions online for accurate reporting.

Related links form

The 990-EZ form is a shorter version of Form 990 designed for organizations with gross receipts between $200,000 and $500,000 and total assets under $500,000. This form allows for more simplified reporting compared to the full Form 990 while still providing detailed financial information. Understanding the 990 Schedule N Instructions can help organizations decide whether to use 990-EZ or another form based on their size and financial status.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.