Loading

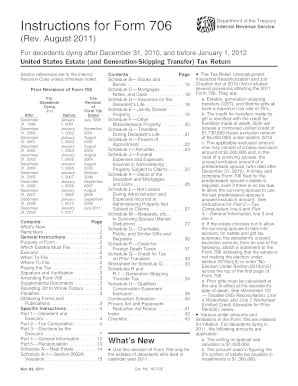

Get Form 706 Rev August 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 706 Rev August 2011 online

Filling out Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, is an important step in managing the estate of a decedent. This guide provides comprehensive instructions on how to complete the form online, making the process user-friendly for everyone, including those with little legal experience.

Follow the steps to accurately complete Form 706 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part 1, which requires you to enter information about the decedent and the executor. Include the name, Social Security Number, and address of the executor.

- Proceed to Part 2 where you will compute the tax on the gross estate. Use the provided tables and instructions to establish the taxable estate value.

- In Part 3, indicate any elections made by the executor. This includes choosing alternate valuation if applicable.

- In Part 4, provide general information about the estate, including filing deadlines and the executor's documentation.

- Complete Part 5, also known as Recapitulation, where you summarize all values and deductions claimed.

- Fill out all relevant schedules (A through O) based on the assets, debts, and deductions associated with the estate.

- After integrating all the necessary information, review for accuracy and completeness.

- Once completed, save changes, and export the document as needed for filing or sharing purposes.

Start filling out Form 706 online now to ensure accurate and timely submission.

UsLegalForms provides comprehensive resources and templates for completing Form 706 Rev August 2011 accurately. Their platform streamlines the process, ensuring you do not miss any critical steps or details. Using UsLegalForms can make navigating estate tax filing simpler and more efficient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.