Loading

Get Form 706 Rev August 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 706 Rev August 2011 online

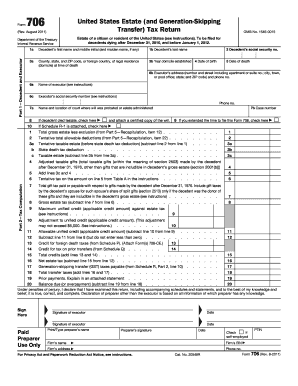

Filling out the Form 706 Rev August 2011, the United States Estate (and Generation-Skipping Transfer) Tax Return, can be a straightforward process when approached step by step. This guide will provide clear instructions to help you navigate the form with confidence.

Follow the steps to fill out the form online with ease.

- Click the ‘Get Form’ button to obtain the form and open it in the document editor.

- Begin with Part 1, where you will need to enter the decedent's name, social security number, and demographic details including dates of birth and death. Ensure that this information matches official records.

- Next, provide the details of the executor, including their name, address, and social security number. This section may also require information on the court where the will was probated.

- Proceed to Part 2, Tax Computation, where you will need to calculate the total gross estate and allowable deductions. Carefully follow the instructions to subtract and present the necessary amounts.

- Continue to Part 3, which consists of elections by the executor. Respond to each of the questions, marking 'Yes' or 'No' as appropriate, based on the specifics of the estate.

- Move onto Parts 4 and 5, where you will provide general information and details about the estate's assets. Make sure to report any transfers made during the decedent's life and any jointly owned property.

- Complete the remaining schedules and attach required documents such as copies of appraisals, insurance policies, and the death certificate.

- Once you have filled out all sections and schedules, finalize your document. Review for accuracy and completeness before saving your changes.

- Depending on your needs, you can download, print, or share the completed form.

Start filling out your Form 706 online today for a smooth filing experience.

Form 706 Rev August 2011 is primarily concerned with the estate tax of deceased individuals, while Form 709 deals with the gift tax responsibilities during a person's lifetime. Form 706 investigates the value of an individual's entire estate upon death, whereas Form 709 tracks monetary gifts given beyond a certain threshold. Understanding these differences can help in proper estate and gift planning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.