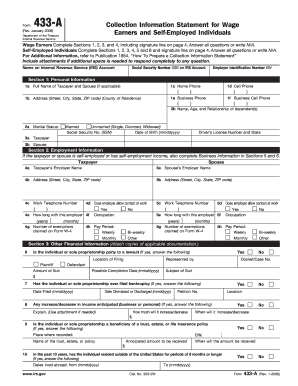

Get Form 433-a (rev. January 2008). Collection Information Statement For Wage Earners And Self-employed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 433-A (Rev. January 2008). Collection Information Statement For Wage Earners And Self-Employed online

Filling out the Form 433-A can seem daunting, but with guided instructions, it becomes a manageable process. This guide offers detailed steps tailored to both wage earners and self-employed individuals, ensuring you provide all necessary information accurately.

Follow the steps to successfully complete your Form 433-A online.

- Press the ‘Get Form’ button to retrieve the form and open it for editing. Ensure you have a reliable internet connection for a smooth experience.

- Begin with Section 1 by filling in your personal information. Include your full name, address, and contact numbers. If applicable, provide details for your spouse and dependents.

- In Section 2, provide employment information. For both yourself and your spouse, list employer details, including names, addresses, and contact numbers. Specify your occupations and pay periods.

- Move to Section 3 for other financial information and answer any questions about lawsuits, bankruptcies, or anticipated changes in income. Use additional space or attachments if necessary.

- Fill out Section 4, which requests personal asset information. Include details on cash, bank accounts, investments, and personal property, ensuring to specify values and loan balances.

- If you are self-employed, complete Sections 5 and 6 with related business information. Provide details about the business structure, cash on hand, bank accounts, and a summary of income and expenses.

- Review all completed sections, verifying that all questions are answered. If a section does not apply to you, indicate 'N/A.' Do not forget to sign the certification.

- Finally, after confirming that all necessary documents are attached, you can save your changes, download, print, or share the form as needed.

Start filling out your Form 433-A online today and ensure your information is accurately reported.

To prove self-employment income to the IRS, you should provide documentation such as your tax returns, profit and loss statements, and bank statements. Additionally, keep records of invoices, receipts, and any 1099 forms that show your earnings. The documentation supports your claims reported on Form 433-A (Rev. January 2008) and helps the IRS understand your financial situation accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.