Loading

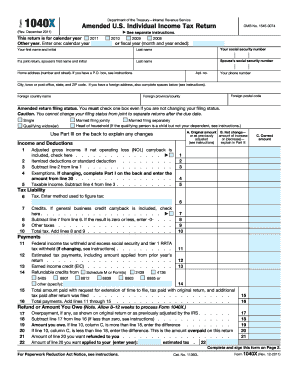

Get 20111040x Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 20111040x Form online

Filling out the 20111040x Form online can streamline the process of amending your U.S. Individual Income Tax Return. This guide will walk you through each section and field of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to successfully complete the form online.

- Use the 'Get Form' button to access the 20111040x Form and open it for editing.

- Begin by entering your personal information. This includes your first name, last name, and social security number. If submitting a joint return, fill in the corresponding details for your partner.

- Provide your home address, including any apartment number, and your contact number. If you have a foreign address, complete the additional fields regarding foreign country and postal code.

- Indicate your amended return filing status by checking the appropriate box. You must check one box even if you are not changing your filing status.

- Fill out the income and deductions section. Start with your adjusted gross income, list your itemized deductions or standard deduction, and complete the exemption information as necessary.

- Proceed to calculate your tax liability by entering your tax, available credits, and any other taxes. Ensure you total these accurately.

- Complete the payments section by providing details on federal income tax withheld, estimated tax payments, and any refundable credits.

- Calculate any refund or amount owed. This will involve subtracting previous amounts from your total payments.

- If your exemptions changed, fill out Part I to adjust your exemption claims. Include the correct number of exemptions in the designated fields.

- In Part III, provide an explanation of the changes you're making that necessitated this amendment. Attach any supporting documents if required.

- Finally, ensure you sign and date the form as required, and remember to keep a copy of the completed form for your records.

Start filling out your 20111040x Form online today to ensure your tax matters are handled efficiently.

You may withdraw form 10IEA in the same year, but be aware of the specific guidelines for such withdrawals. Generally, you should consult with a tax expert or refer to IRS guidance. If you're unsure, resources like uslegalforms can provide assistance with form understanding and procedures.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.