Loading

Get 1040nr 2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

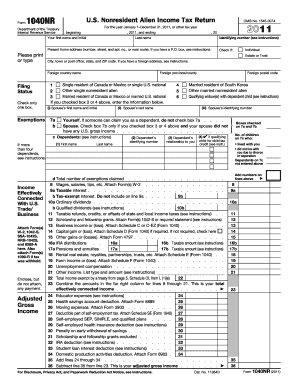

How to fill out the 1040nr 2011 Form online

Filling out the 1040nr 2011 Form online can be a straightforward process when you have a clear understanding of each section. This guide provides step-by-step instructions to help users accurately complete their Nonresident Alien Income Tax Return with confidence.

Follow the steps to effectively complete the 1040nr 2011 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name, identifying number, and present home address at the top of the form. Ensure that you follow the instructions carefully, especially if you have a P.O. box.

- Select your filing status by checking the appropriate box that corresponds to your situation, such as 'Single resident of Canada' or 'Other single nonresident alien'.

- List any dependents you are claiming. If applicable, provide the required identifying information for each dependent.

- Report your income details in the appropriate sections, including wages, interest, dividends, and any other sources of income. Attach necessary forms such as W-2s or 1042-S.

- Calculate your adjusted gross income by following the instructions for deductions applicable to you. Ensure you reference any necessary schedules.

- Complete the tax and credits section by applying any available credits, such as the foreign tax credit, and determining your taxable income.

- Fill out the payment sections where you will report any federal tax withheld and other payments. If you have an overpayment, specify the amount you wish refunded.

- Sign the form electronically where required and include your occupation in the U.S. Make sure to review all information for accuracy.

- Finally, save your changes, and consider downloading or printing the form for your records. You may also share it if necessary.

Complete your 1040nr 2011 Form online to ensure accurate filing today.

To file a non-resident alien tax return, complete the 1040NR 2011 Form accurately and gather all necessary documentation. Ensure you report all income from U.S. sources. For assistance, look to uslegalforms, which offers easy-to-follow instructions and templates tailored for non-resident alien tax filers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.