Get 2011 Schedule C Ez Part Iii Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Schedule C-EZ Part III Form online

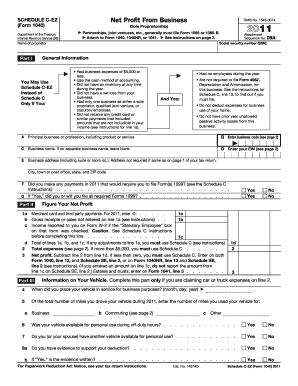

Filling out the 2011 Schedule C-EZ Part III Form online can simplify reporting your business income and expenses. This guide provides detailed instructions to help you smoothly complete the form and ensure accuracy in your filing.

Follow the steps to effectively complete the Schedule C-EZ Part III Form online.

- Click ‘Get Form’ button to access the Schedule C-EZ Part III Form and open it in your chosen editor.

- Begin by entering your social security number (SSN) at the top of the form if it is not already provided.

- In Part I, provide your name as the proprietor and enter the business name if applicable. If there is no separate business name, leave that field blank.

- Enter your business address including suite or room number if applicable. If this matches your main tax return address, you may leave it blank.

- In Part II, figure your net profit by entering your gross receipts or sales. This includes any income reported on Form W-2 if you are a statutory employee.

- Calculating total expenses is crucial; enter deductible business expenses incurred during the year on the designated line. If they exceed $5,000, you will need to file Schedule C instead.

- Proceed to Part III and provide information on your vehicle only if you're claiming car or truck expenses. Fill in the date when the vehicle was first used for business.

- Enter the business miles, commuting miles, and any other miles driven during the tax year. Ensure to answer yes or no regarding personal use of the vehicle and whether you have evidence to support your deduction.

- After reviewing all entries for accuracy, save your changes in the format preferred for record-keeping. You can also download, print, or share the completed form as needed.

Start filling out your 2011 Schedule C-EZ Part III Form online today to ensure compliance and accuracy in your business reporting.

Line 31 on the 2011 Schedule C Ez Part Iii Form refers to your net profit or loss from your business. This line calculates your business income after deducting allowable expenses. Understanding this line is essential because it determines your taxable income, directly impacting your overall tax liability. Accurate reporting here is crucial for maintaining compliance with tax regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.