Loading

Get Irs Itemized Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS itemized form online

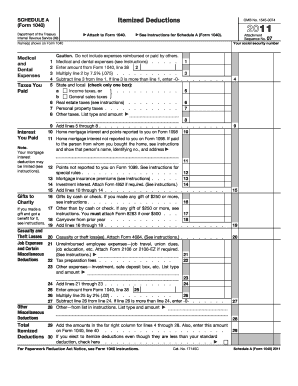

Filling out the IRS itemized form can seem daunting, but with this guide, users can navigate through the process easily and accurately. This document helps taxpayers itemize deductions to potentially lower their taxable income, leading to potential tax savings.

Follow the steps to accurately complete the IRS itemized form online.

- Press the ‘Get Form’ button to obtain the IRS itemized form and open it in your preferred editing tool.

- Begin by entering your social security number and the names displayed on your Form 1040 at the top of the form.

- Proceed to the 'Medical and Dental Expenses' section. Enter the total amount of eligible medical expenses on line 1. This amount should not include any costs reimbursed or paid by others.

- On line 2, calculate 7.5% of the amount from line 1 by multiplying by 0.075.

- Subtract the amount on line 2 from line 1. If the result is negative, enter '-0-' on line 3.

- In the 'Taxes You Paid' section, choose only one option between state and local income taxes (line 5) or general sales taxes (line 6) by checking the corresponding box.

- Enter the amounts for real estate taxes (line 7) and personal property taxes (line 8). For line 8, list any other taxes with their type and amount.

- Add together the totals from lines 5 through 8, and enter this figure on line 9.

- For mortgage interest, input the amount reported on Form 1098 in line 10.

- Enter any home mortgage interest that is not reported on Form 1098 on line 11, along with the name and address of the mortgage holder.

- If applicable, input points not reported to you on Form 1098 on line 12.

- Line 13 is for mortgage insurance premiums; enter the required amount here.

- Proceed to line 15 to add up all amounts from lines 10 to 14.

- In the 'Gifts to Charity' section, report any gifts made in cash or check (line 16), and additional gifts not made by cash or check (line 17). If applicable, you may need to attach Form 8283 for significant contributions.

- Line 19 should reflect the total from lines 16 through 18.

- For casualty or theft losses, enter the amount on line 20 and ensure you attach Form 4684 as instructed.

- For job expenses, report unreimbursed employee expenses on line 21, and any other miscellaneous deductions on lines 22 through 28.

- Line 29 totals the amounts from the right column for lines 4 through 28; this will be entered on Form 1040 line 40.

- Lastly, if you choose to itemize deductions that are less than your standard deduction, check the box on line 30.

- Once all fields are complete, save your changes and choose to download, print, or share the completed form as required.

Complete your IRS itemized form online today for easy submission and potential savings.

To fill out itemized deductions, start with IRS Form 1040 Schedule A. List each deduction in the appropriate section and ensure all amounts are correct. If needed, use resources like UsLegalForms to guide you through the process, making it easier to file your IRS itemized form accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.