Get Form St-121.2:11/08:certificate Of Exemption For Purchases Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST-121.2:11/08:Certificate Of Exemption For Purchases Of ... online

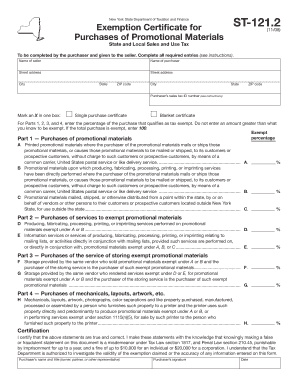

Filling out the Form ST-121.2 is an essential step for users purchasing promotional materials or services related to them. This guide provides clear instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- In the 'Name of seller' field, enter the name of the seller from whom you are purchasing the promotional materials.

- In the 'Name of purchaser' field, input your own name or the name of your business.

- Provide the street address, city, state, and ZIP code for both the seller and the purchaser in their respective fields.

- Mark an 'X' in one of the two boxes to indicate whether this is a single purchase certificate or a blanket certificate.

- If you are registered for sales tax purposes, enter your sales tax ID number in the appropriate field. If not applicable, enter N/A.

- For Parts 1 through 4, indicate the percentage of the purchase that qualifies for tax exemption. Make sure not to exceed the actual exempt amount known.

- In Part 1, enter the qualifying percentages for purchases of promotional materials categorized under A, B, and C.

- In Part 2, record the exempt percentages for services related to promotional materials under sections D and E.

- For Part 3, fill in the exempt percentages for storage services indicated in fields F and G.

- Complete Part 4 by entering the exempt percentages for mechanicals and artwork in field H.

- After filling out all sections, you or your representative must certify the accuracy of the information by signing the form, providing your name, title, and the date.

- Finally, save your changes, download, print, or share the form as necessary.

Complete your exemption certificate online to ensure your purchases are processed efficiently.

In North Carolina, obtaining a sales tax exemption certificate involves completing the E-595E form, specifying your tax-exempt status and the nature of your purchases. You will need to provide this form to the seller from whom you are making purchases. The Form ST-121./08:Certificate Of Exemption For Purchases Of .... can significantly simplify this process, ensuring you have the correct documentation to assist with all tax-exempt transactions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.