Loading

Get 2012 Federal Witholding Table For Single Fillers Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Federal Withholding Table For Single Fillers Form online

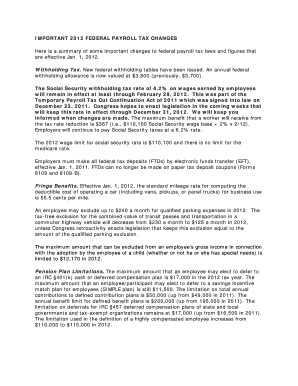

This guide provides clear and detailed instructions on how to effectively complete the 2012 Federal Withholding Table For Single Fillers Form online. By following each step, users will ensure accurate withholding calculations for their federal income tax.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Review the top section of the form for preliminary details and instructions that guide you through the filling process. Ensure that you understand the purpose of the withholding table.

- Locate the section that requests your filing status. As a single filer, ensure that you select or fill in the appropriate option marked for single individuals.

- Find the income section where you will input your annual income. Be precise in entering your total expected income for the year, as this will affect your withholding amount.

- Refer to the withholding table provided within the form. Cross-reference your income with the appropriate allowance amount to determine your federal withholding.

- Input the calculated withholding amount in the designated field on the form.

- Once all sections are completed, review your entries carefully for accuracy. Ensure all required information is filled out correctly.

- After finalizing your form, you can save changes, download, print, or share the completed form as needed.

Start filling out your documents online to ensure compliance and accurate withholding.

To calculate taxable income, start with the sum of all your income sources, then deduct any applicable adjustments and standard deductions. The process may require referencing the 2012 Federal Withholding Table For Single Fillers Form to ensure correct withholding amounts. Accurate calculations ensure that you understand your tax situation clearly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.