Loading

Get Form Ct 1120k

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-1120K online

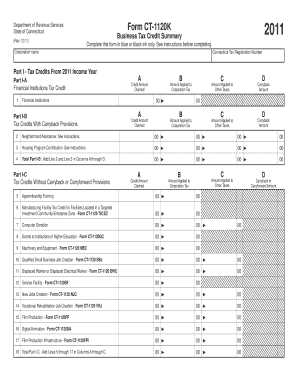

The Form CT-1120K is a Business Tax Credit Summary used in Connecticut to report tax credits that corporations are claiming. This guide provides clear, supportive instructions to help users complete the form accurately online.

Follow the steps to fill out the Form CT-1120K online.

- Click the ‘Get Form’ button to obtain the form and access it in the editor.

- Provide the corporation name and Connecticut Tax Registration Number in the designated fields at the top of the form.

- Complete Part I, section A by entering the Financial Institutions Tax Credit details, including the amount claimed and amounts allocated to corporation tax and other taxes.

- In Part I-B, fill in the tax credits with carryback provisions by entering the applicable amounts claimed and applied across the columns provided.

- Continue to Part I-C, where you will report tax credits without carryback or carryforward provisions, ensuring to fill in the corresponding amounts.

- Move to Part I-D to account for tax credits with carryforward provisions, entering the amounts from previous years and those claimed for the current income year.

- In Part I-E, report the Electronic Data Processing Equipment Property Tax Credit and ensure that all amounts align with previously entered data.

- Proceed to Part II and Part III to apply the tax credits accordingly, following the instructions outlined in the form for each tax type.

- Finally, review all entries for accuracy. Once completed, save your changes, download a copy of the form, print it, or share it as needed.

Complete the Form CT-1120K online today to ensure your business tax credits are accurately reported.

Certain complex tax forms may not be eligible for electronic filing. This often includes forms with special circumstances, certain foreign income, and some specific circumstances unique to the taxpayer's situation. Always verify current eligibility with the IRS, especially concerning your filings for form Ct 1120k to avoid any issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.