Get F8938

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F8938 online

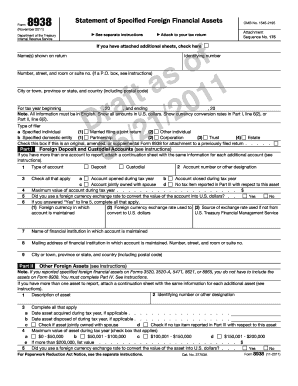

The F8938 form, officially titled Statement of Specified Foreign Financial Assets, is an important document for individuals and entities reporting their foreign financial interests to the IRS. Completing this form accurately is crucial for compliance with federal tax requirements.

Follow the steps to fill out the F8938 form online.

- Click ‘Get Form’ button to obtain the F8938 form and open it in your preferred online editor.

- Begin by filling in the name(s) shown on your tax return. This should reflect exactly how it appears on your official tax documents.

- Enter your identifying number, which is typically your Social Security number or Employer Identification Number depending on your filing status.

- Provide the number, street, and room or suite number of your residence. If you have a P.O. box, refer to the specific instructions.

- Next, indicate your city or town, province or state, and country including the postal code to identify your legal residence.

- Fill in the tax year for which you are reporting, using the format specified on the form.

- Select your type of filer, choosing from options such as specified individual, partnership, corporation, or other classifications.

- In Part I, report your foreign deposit and custodial accounts, providing details for each account including account number, account type, and maximum value during the tax year.

- If applicable, indicate whether the account was opened or closed during the tax year and if it was jointly owned with a spouse.

- Part II requires you to list other foreign assets. Provide a description, maximum value during the tax year, and details on any currency conversions used.

- As you complete Part III, summarize tax items attributable to your specified foreign financial assets, listing amounts and where they are reported.

- Finally, ensure all information is verified for accuracy, then save your changes, download the document, or share it as needed.

Take action today to complete your F8938 form online and stay compliant with IRS requirements.

To fill out the declaration form, begin by understanding the specific requirements related to the F8938. Clearly indicate all necessary information regarding foreign assets and liabilities, ensuring completeness and accuracy. It is vital to follow the instructions provided with the form to avoid omissions. Utilizing tools and services from platforms like uslegalforms may offer additional support in efficiently completing this document.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.