Get Illinois Schedule Icr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois Schedule Icr online

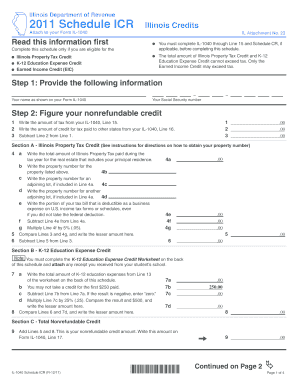

Filling out the Illinois Schedule ICR form is essential for individuals looking to claim various tax credits associated with property taxes and education expenses. This guide will provide you with clear and detailed instructions on how to complete the form efficiently online, ensuring you do not miss any important steps.

Follow the steps to complete your Illinois Schedule ICR form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your name as it appears on your Form IL-1040 and your Social Security number in the designated fields.

- Figure your nonrefundable credit. Start with Line 1 by writing the amount of tax from your IL-1040, Line 15. Proceed to Line 2 and input the credit for tax paid to other states from Line 16. Finally, subtract the amount in Line 2 from Line 1 to complete Line 3.

- In Section A for the Illinois Property Tax Credit, write the total amount of property tax paid for your principal residence on Line 4a. Include the property number on Line 4b and for any adjoining lots on Lines 4c and 4d.

- Subtract any deductible portion reported on Line 4e from the total you entered in Line 4a. Multiply the result by 5% and write this value on Line 4g. Compare this amount to Line 3 and record the lesser value on Line 5.

- Continue by completing Section B for the K-12 Education Expense Credit. Fill out the K-12 Education Expense Credit Worksheet on the back of Schedule ICR first, then write the amount from Line 13 of that worksheet on Line 7a. Be careful to follow the directions regarding the first $250 of expenses.

- Finally, add the amounts from Lines 5 and 8 to calculate your total nonrefundable credit, which you will write on Line 9, ready to be submitted with your Form IL-1040.

- Once you have completed the form, make sure to save your changes. You may then download, print, or share the form as needed based on your filing preferences.

Complete your Illinois Schedule ICR form online today to ensure you claim your eligible tax credits.

The Illinois replacement tax investment credit is designed to incentivize businesses by allowing them to receive credits against specific taxes. This credit applies to investments made in qualified property and can significantly lower your tax bills. Understanding how this credit applies to your situation, including the Illinois Schedule Icr, can enhance your financial planning. Accessing resources from uslegalforms can simplify this process for you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.