Loading

Get Dr 15ezcsn Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr 15ezcsn Form online

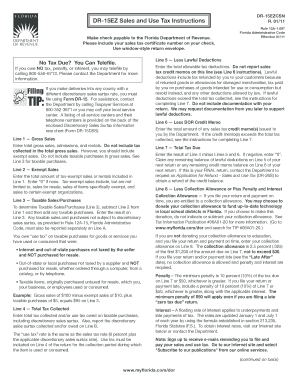

The Dr 15ezcsn Form is essential for reporting sales and use tax in Florida. This guide provides a detailed walkthrough to assist users in completing the form accurately online, ensuring compliance and efficiency in tax reporting.

Follow the steps to successfully complete the Dr 15ezcsn Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your gross sales, admissions, and rentals on Line 1. Ensure you do not include tax collected in this total, but do include exempt sales.

- On Line 2, document any exempt sales or rentals included in Line 1. If there are none, enter '0'.

- Calculate taxable sales and purchases for Line 3. Subtract Line 2 from Line 1 and add any taxable purchases to this amount, and then enter the result.

- Enter the total tax collected on Line 4, which includes any discretionary sales surtax. Make sure to report it accurately.

- On Line 5, provide the total allowable tax deductions. Remember, do not report sales tax credit memos here.

- Enter any DOR credit memo amounts on Line 6. Ensure your calculations are correct to avoid discrepancies.

- Calculate your total tax due on Line 7 by subtracting Lines 5 and 6 from Line 4. If the result is negative, enter '0'.

- If applicable, indicate your collection allowance on Line 8 or apply penalties and interest if you filed late.

- Enter the final amount due with the return on Line 9, which is derived from the calculations above.

- Finally, review your form for accuracy, sign in the designated spaces, and provide any required contact information.

- You can then save changes, download, print, or share the completed form as needed.

Start filling out your Dr 15ezcsn Form online today for a smooth tax filing experience.

Related links form

Filing sales tax late in Florida may result in significant penalties, which can include a percentage of the tax due. The longer you delay, the higher the costs can become. Timely submission of the Dr 15ezcsn Form is crucial to avoid these penalties. If you've missed a deadline, consulting with uslegalforms can provide you with guidance on next steps to mitigate any adverse consequences.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.