Loading

Get Taxformsetsorg

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Taxformsetsorg online

Filling out the Taxformsetsorg online is a straightforward process designed to simplify your tax preparation. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the Taxformsetsorg online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

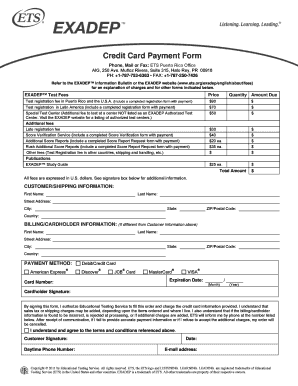

- Fill in your personal details in the Customer/Shipping Information section, including your first name, last name, street address, city, state, ZIP/postal code, and country.

- If the billing information differs from the customer information, complete the Billing/Cardholder Information section with the necessary details.

- Select your preferred payment method from the options provided, including American Express, Discover, JCB, MasterCard, and VISA. Enter the card number and expiration date.

- Provide the Cardholder Signature to authorize the charge to your credit card. Make sure you understand and agree to the terms and conditions listed.

- Include your daytime phone number and email address for future correspondence regarding your order.

- Review all entered information for accuracy, ensuring that all sections are filled out correctly.

- Save your changes, and download or print the completed form for your records or further submission requirements.

Complete your documents online today for a seamless experience.

Filing an income tax return as a beginner starts with understanding the necessary forms and identifying your income sources. Utilize simple tax software to guide you through the process and maximize your deductions. Exploring resources on Taxformsetsorg can help ease any confusion while providing support throughout your filing journey.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.