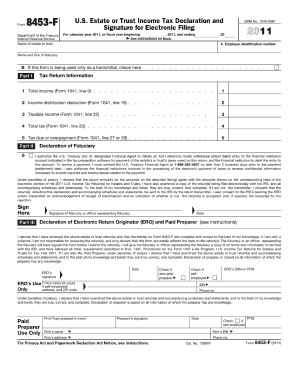

Get 2011 Irs Form 8453 F

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 IRS Form 8453 F online

This guide provides a comprehensive overview of how to successfully complete the 2011 IRS Form 8453 F online. By following these clear, step-by-step instructions, users can ensure accurate submission and compliance with IRS requirements.

Follow the steps to fill out the form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred electronic editor.

- Review the form carefully and start filling in the personal information section, including your name, address, and Social Security number. Ensure that all details are accurate to avoid delays in processing.

- Proceed to the next section, where you will provide information regarding the tax year and the type of return being filed. It is important to confirm that this information aligns with your complete tax return.

- Continue by completing the declaration section. Here, you will need to indicate your consent to electronically file the return and include any applicable third-party designee information if required.

- Once all sections are filled out, review the form thoroughly to check for any errors or omissions that could affect the submission process.

- Finally, save your changes, and download the completed form. You can also print or share it as necessary to ensure you have copies for your records.

Embrace the convenience of filling documents online and streamline your filing process today.

If you fail to mail the 2011 IRS Form 8453 when required, your electronic tax return may not be considered complete by the IRS. This could lead to delays in processing your return, potential penalties, or complications with future tax filings. It’s crucial to follow through on mailing this form if you’re prompted to do so by your tax software. To avoid problems, you can find helpful resources and templates on the US Legal Forms website.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.