Loading

Get 8453 Signature Document

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8453 Signature Document online

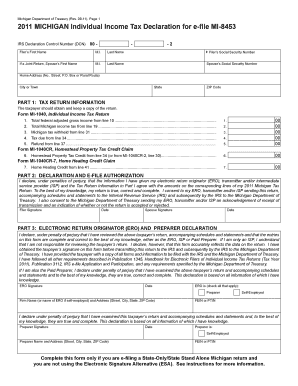

The 8453 Signature Document is essential for completing your Michigan Individual Income Tax e-filing. This guide provides step-by-step instructions to help you navigate and fill out the document efficiently and accurately.

Follow the steps to complete your 8453 Signature Document online.

- Click ‘Get Form’ button to access the 8453 Signature Document and open it for editing.

- Enter the filer’s first name, middle initial, and last name in the appropriate fields at the top of the form. If filing jointly, also include the spouse's name.

- Provide the filer’s social security number and the spouse's social security number.

- Fill in the home address, including street number, street name, city or town, state, and ZIP code.

- In Part 1, enter the relevant tax return information. Begin by including the total federal adjusted gross income, total Michigan income tax, and Michigan tax withheld using the figures from Form MI-1040.

- Complete any additional fields in Part 1 related to tax due, refund, homestead property tax credit, and home heating credit.

- For Part 2, review the declaration statement and sign to confirm that the information provided is accurate and complete. Include the date of signing.

- In Part 3, the electronic return originator (ERO) must enter their information and sign the document, ensuring all details are accurate.

- After the document is completed, the taxpayer can save changes or download the form for their records.

- Finally, if necessary, print the completed form or share it as required. If filing online without a tax preparer, remember to mail the signed form to the Michigan Department of Treasury within three business days post-acknowledgment.

Complete your 8453 Signature Document online to ensure your tax filing is processed smoothly.

Form 8843 should be filled out by certain nonresident aliens who are present in the U.S. for specific visas but do not qualify as residents for tax purposes. This form helps establish your status and is crucial to avoid additional taxation. Ensure you complete this accurately to maintain your tax compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.