Get 2011 Form 593 B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form 593 B online

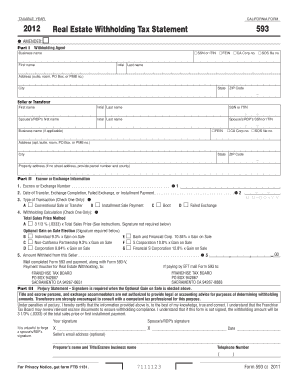

This guide provides clear and supportive instructions on how to complete the 2011 Form 593 B, the Real Estate Withholding Tax Statement, online. Whether you are a first-time filer or seeking clarification on specific sections, this step-by-step guide will assist you throughout the process.

Follow the steps to complete the 2011 Form 593 B online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out Part I for the withholding agent. You need to enter the business name, first name, initial, last name, and address details, including city, state, and zip code. Additionally, include the appropriate identification numbers such as SSN, ITIN, FEIN, CA Corp number, or SOS file number.

- Provide detailed information for the seller or transferor. Enter their first name, initial, last name, and SSN or ITIN. If applicable, include the spouse's or partner's first name, initial, last name, and identification number.

- Complete Part II, starting with the escrow or exchange information. Enter the escrow or exchange number and the date of transfer or exchange completion.

- Select the type of transaction by checking the appropriate box (conventional sale, installment sale, boot, or failed exchange) and provide the withholding calculation based on your selected method.

- In the amount withheld section, calculate the appropriate withholding based on either the total sales price or the stated gain on sale election and enter the result.

- Proceed to Part III, the perjury statement, where the seller and preparer must fill in their information. A signature is necessary if the optional gain on sale has been elected.

- After reviewing the completed form for accuracy, save your changes, and you may now download, print, or share the form as needed.

Complete the 2011 Form 593 B online today to ensure efficient processing of your real estate withholding requirements.

California Form 590 is required for individuals or businesses that aim to claim an exemption from withholding. This applies mainly to California residents and certain other qualified sellers. Using the 2011 Form 593 B correctly helps to streamline the process of tax compliance, while Form 590 provides the avenue for specific exemptions. Ensure to review the eligibility criteria to determine if you need this form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.