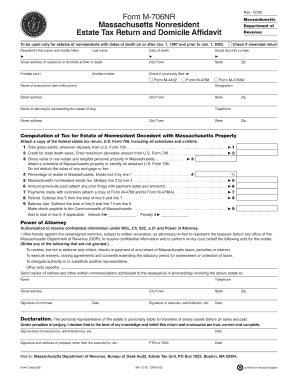

Get Form M-706nr - Mass.gov - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Form M-706NR - Mass.Gov - Mass online

How to fill out and sign Form M-706NR - Mass.Gov - Mass online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The times of frightening complex tax and legal documents are over. With US Legal Forms the process of creating legal documents is anxiety-free. The leading editor is directly at your fingertips providing you with various useful instruments for completing a Form M-706NR - Mass.Gov - Mass. These guidelines, with the editor will assist you through the complete process.

- Click on the Get Form option to begin modifying.

- Switch on the Wizard mode in the top toolbar to get additional recommendations.

- Complete each fillable area.

- Ensure that the information you fill in Form M-706NR - Mass.Gov - Mass is updated and correct.

- Add the date to the record using the Date function.

- Click on the Sign button and create an e-signature. Feel free to use 3 options; typing, drawing, or uploading one.

- Double-check each and every field has been filled in properly.

- Click Done in the top right corne to save and send or download the document. There are several choices for getting the doc. An attachment in an email or through the mail as a hard copy, as an instant download.

We make completing any Form M-706NR - Mass.Gov - Mass faster. Get started now!

How to edit Form M-706NR - Mass.Gov - Mass: customize forms online

Facilitate your document preparation process and adapt it to your demands within clicks. Complete and sign Form M-706NR - Mass.Gov - Mass using a comprehensive yet easy-to-use online editor.

Managing documentation is always difficult, particularly when you deal with it from time to time. It demands you strictly adhere to all the formalities and accurately fill out all fields with full and precise information. Nevertheless, it often happens that you need to adjust the document or add more fields to fill out. If you need to optimize Form M-706NR - Mass.Gov - Mass prior to submitting it, the easiest way to do it is by using our robust yet easy-to-use online editing tools.

This extensive PDF editing solution allows you to quickly and easily fill out legal paperwork from any internet-connected device, make simple changes to the template, and insert more fillable fields. The service allows you to opt for a specific area for each data type, like Name, Signature, Currency and SSN etc. You can make them mandatory or conditional and decide who should fill out each field by assigning them to a defined recipient.

Make the steps below to modify your Form M-706NR - Mass.Gov - Mass online:

- Open needed sample from the catalog.

- Fill out the blanks with Text and place Check and Cross tools to the tickboxes.

- Use the right-side toolbar to modify the form with new fillable areas.

- Opt for the fields based on the type of information you wish to be collected.

- Make these fields mandatory, optional, and conditional and customize their order.

- Assign each area to a specific party with the Add Signer tool.

- Check if you’ve made all the necessary modifications and click Done.

Our editor is a universal multi-featured online solution that can help you quickly and effortlessly adapt Form M-706NR - Mass.Gov - Mass and other forms according to your requirements. Minimize document preparation and submission time and make your paperwork look professional without hassle.

When mailing your Massachusetts tax return, including Form M-706NR - Mass - Mass., ensure you send it to the correct address provided in the form instructions. Typically, the mailing address varies based on whether you owe taxes or are expecting a refund. Double-checking the details will help avoid any delays in processing your return.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.