Loading

Get Irs Form 8387

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 8387 online

Filling out the Irs Form 8387 online is an essential task for ensuring compliance with employee benefit plan requirements. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Irs Form 8387 online.

- Click the ‘Get Form’ button to download and open the Irs Form 8387 in your preferred editor.

- Begin filling out the form by entering the required information in the 'Date' field, which indicates when the form is being completed.

- In the 'Name of Plan' section, provide the official name of the employee benefit plan related to the distribution.

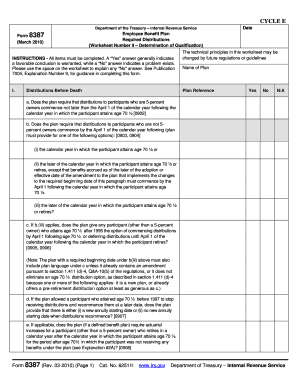

- Refer to the 'Required Distributions' section and evaluate each question under the 'Yes', 'No', and 'N/A' columns. Make sure to provide explanations for any 'No' answers in the space provided on the worksheet.

- Continue through Sections I, II, III, IV, and V, answering each question accurately and thoroughly. In each section, pay close attention to the specific conditions outlined for distributions before and after death.

- Once all sections have been completed, review the information for accuracy and completeness to ensure compliance with regulations.

- After finalizing your entries, you can save the changes made to the document and choose to download, print, or share the completed Irs Form 8387 as necessary.

Complete your Irs Form 8387 online today to stay compliant with employee benefit plan distribution rules.

Disclosure about your retirement plan includes providing key information to participants regarding investment options, fees, and plan features. Transparency is vital for building trust and ensuring that participants understand their benefits. Incorporating IRS Form 8387 disclosures can help you comply with regulations and enhance participant engagement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.