Loading

Get 1099cc Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099cc Form online

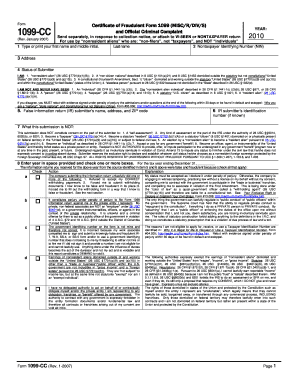

This guide provides a clear and supportive approach to filling out the 1099cc Form online. It is designed for users of all experience levels and aims to simplify the process while ensuring compliance.

Follow the steps to complete the 1099cc Form online.

- Press the ‘Get Form’ button to obtain the form and access it in your preferred online editor.

- Enter your first name and middle initial, followed by your last name in the designated fields.

- Input your nontaxpayer identifying number (NIN) in the appropriate box.

- Provide your current address in the space provided.

- Select your status from the provided options, ensuring you choose the one that accurately reflects your situation as a non-resident alien or non-citizen.

- If applicable, enter the false information return submitter’s name, address, and zip code.

- Include the identification number of the false information return submitter, if known.

- In the section regarding the year, enter the tax year you are reporting for and check any boxes that apply to indicate actions that were unlawfully taken against you.

- Outline any efforts you made to notify the IRS or the person filing the false 1099 concerning correcting reports.

- Specify the actions you are demanding from the recipient in response to this submission.

- Finally, review the entire form for accuracy, sign it in the designated section, and specify the date.

- Once you have filled out the form completely, you can save your changes, download it for your records, print, or share it as necessary.

Begin filling out your 1099cc Form online today to ensure all necessary information is accurately reported.

Copy C of a 1099 is provided to the recipient of the form for their records. This is an important copy that you should keep for your personal tax documentation. Ensure that you have received your correct copy of the 1099-C form to properly report any income in your tax filings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.