Loading

Get K120s 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the K120S 2018 online

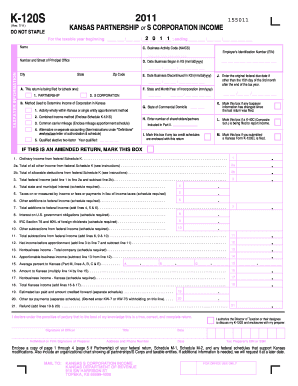

Filling out the K120S 2018 form online is a straightforward process designed for partnerships and S corporations in Kansas. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the K120S 2018 form online:

- Click the ‘Get Form’ button to obtain the K120S 2018 form and open it in the editor.

- Enter the beginning and ending dates of the tax year at the top of the form. This is crucial as it determines the reporting period for your income.

- Fill in the name and address of the business entity. Ensure accuracy in this information to avoid processing delays.

- Input the Employer's Identification Number (EIN) — a vital identifier for your business entity.

- Complete the taxpayer information section, indicating whether you are filing for a partnership or S corporation in part A.

- Select the method used to determine income in part B. Options include activity wholly within Kansas or combined income method.

- Fill in the business activity code (NAICS) in part C to specify the nature of your business.

- Provide dates regarding when the business began and, if applicable, when it was discontinued in Kansas.

- Indicate the state and month/year of incorporation and any changes to taxpayer information since the last filing in parts F and K.

- Complete the income section, including details from your federal Schedule K, total deductions, and other relevant financial data.

- Follow the instructions for apportionment of business income if your business operates in multiple states.

- Declare the total Kansas income, estimated tax paid, and any refund calculations at the end of the form.

- Sign the form in the appropriate section, confirming that the information provided is accurate and truthful.

- Save your changes, download the completed form, and print it if necessary for your records or to submit.

Complete your K120S 2018 form online to improve processing speed, save time, and reduce costs.

A Schedule K-1 is typically issued by partnerships, S corporations, estates, or trusts. These entities provide K-1s to their partners or shareholders to report their share of the income, deductions, and tax credits on their own tax returns. If you're involved with K120s 2018, ensure you receive this document from the respective entity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.