Get Delaware 2010 Form 1100x

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Delaware 2010 Form 1100x online

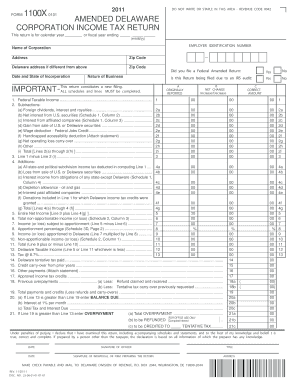

Filling out the Delaware 2010 Form 1100x can be a straightforward process when you know how to navigate through its sections. This guide will provide you with step-by-step instructions on completing the form online, ensuring that you can accurately report any changes to your corporation's income tax return.

Follow the steps to successfully complete your form online.

- Press the ‘Get Form’ button to access and open the form in the editor.

- Complete the basic information fields at the top of the form, including your Employer Identification Number, the name of the corporation, and the address details.

- Indicate the calendar year or fiscal year for which you are filing the amended return by filling in the relevant dates.

- Fill out Section A titled 'Originally Reported' by entering the federal taxable income and any necessary subtractions and additions, as indicated on the form.

- For each line in the form, ensure that you are accurately reporting figures and completing all necessary schedules. This includes entering relevant information regarding foreign dividends, interest, and any deductions.

- Move to the income sections, including 'Entire Net Income' and 'Non-apportionable income,' making sure to complete the calculations as described.

- Complete the 'Delaware Taxable Income' calculation and detail any tax credits you may be claiming.

- Review your entries to verify accuracy before you finalize the form.

- Once all required fields and sections are completed, you can save your changes, download the form, print it, or share it as needed.

Complete your Delaware 2010 Form 1100x online to ensure your corporation meets its tax obligations.

The form required for Delaware sales tax exemption is typically the Delaware Sales Tax Exempt Certificate. This form allows qualified purchasers to make tax-exempt purchases for certain goods or services. Completing this form is essential for businesses seeking to avoid unnecessary tax expenses. For further guidance on sales tax and exemptions, consulting the Delaware 2010 Form 1100x can be beneficial.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.