Loading

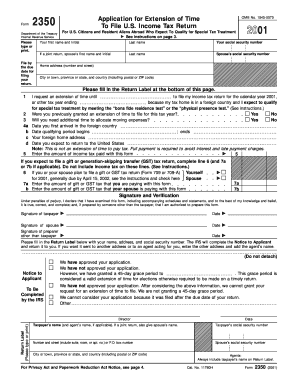

Get 2001 Form 2350. Application For Extension Of Time To File U.s. Income Tax Return - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2001 Form 2350. Application For Extension Of Time To File U.S. Income Tax Return - Irs online

Filing for an extension to submit your U.S. income tax return can be a straightforward process when using the 2001 Form 2350. This guide will walk you through each section, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete your Form 2350 online.

- Click ‘Get Form’ button to obtain the Form 2350 and open it in the editor.

- Enter your first name and initial, followed by your last name and social security number.

- If filing jointly, provide your spouse’s first name, initial, last name, and social security number.

- Fill in your home address, including the number and street, city or town, province or state, and postal or ZIP code.

- Indicate the extension request date by filling in the line that specifies to file your income tax return.

- Answer whether you were previously granted an extension for this tax year.

- Specify if you will need additional time to allocate moving expenses.

- Provide the date you first arrived in the foreign country and the date when your qualifying period begins.

- Fill in your foreign home address accurately.

- Enter the date you expect to return to the United States.

- State the amount of income tax paid with this form.

- If applicable, indicate whether you or your spouse plan to file a gift or GST tax return. If so, enter the amount being paid with this form.

- Both taxpayer and spouse, if filing jointly, must sign and date the form.

- Complete the Return Label with your information to ensure you receive notification about your application.

- After filling out the form, save changes, and proceed to download, print, or share the form securely.

Complete your 2001 Form 2350 online to ensure a smooth filing experience.

Filing an extension after April 15th can be complex and generally requires a valid reason. The 2001 Form 2350 must be submitted on or before this date for the extension to be considered timely. If you miss this deadline, it is advisable to consult with a tax professional for guidance on potential relief options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.