Loading

Get St3 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St3 Form online

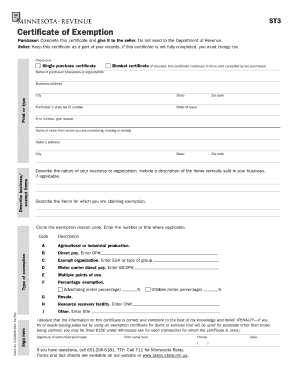

The St3 Form is a vital document for users needing to submit specific information digitally. This guide provides a comprehensive overview of how to complete the form online, ensuring a smooth and efficient process.

Follow the steps to successfully complete the St3 Form online.

- Click the ‘Get Form’ button to access the St3 Form and open it in your preferred editing tool.

- Begin by entering your personal information in the designated fields, including your name, address, and contact details. Ensure all information is accurate and up to date.

- Proceed to the next section where you will need to provide details related to your request. This may include specific data points relevant to your situation or inquiry.

- Review the sections that require supplementary documentation or information. Prepare to attach any necessary files, ensuring they are in an accepted format.

- After filling out all required fields, take a moment to review your entries for completeness and accuracy. Double-check for any spelling or data entry errors.

- Once you are satisfied with the information provided, you can save changes, download the form for your records, or print it directly for submission.

- If necessary, share the completed form with relevant parties via email or another preferred method of communication.

Start completing your St3 Form online today for a seamless experience.

A Schedule 3 form is typically used to report additional information regarding specific income or deductions when filing taxes. This form can accompany your regular tax return and clarify certain aspects of your financial situation. Making use of resources like uslegalforms can ensure your Schedule 3 form is filled out correctly and submitted on time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.