Get Dreyfus Transfer On Death Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dreyfus Transfer On Death Form online

Filling out the Dreyfus Transfer On Death (TOD) Form online is a straightforward process designed to facilitate the transfer of ownership of your shares to designated beneficiaries upon your passing. This guide will walk you through each step of the process, ensuring clarity and ease of understanding.

Follow the steps to complete your Dreyfus Transfer On Death Form online.

- Click ‘Get Form’ button to obtain the Dreyfus Transfer On Death Form. This will allow you to open the form in your preferred online editor.

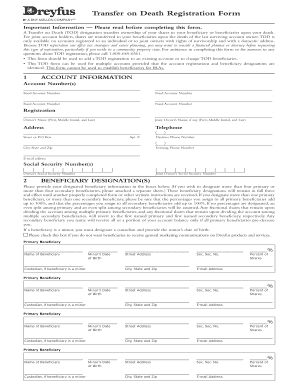

- In the account information section, enter your account number(s) as well as the fund account numbers. Ensure that all information is accurate to avoid processing delays.

- Complete the registration section with your name and the name of any joint owners. Provide your address, daytime and evening phone numbers, email address, and Social Security numbers.

- Move to the beneficiary designations. Fill in the details for each primary and secondary beneficiary, including their names, addresses, Social Security numbers, and the percentage of shares they are to receive. Note that all percentages must total 100% for both primary and secondary beneficiaries.

- If designating a minor as a beneficiary, include a custodian's name and the minor's date of birth. Ensure that this section is filled out completely to avoid issues later.

- Review the signature section. As the account owner, sign and date the form. If applicable, have the joint owner also sign and date the form.

- Finally, save your changes to the form. You may then download, print, or share the completed document as required.

Begin your process of completing the Dreyfus Transfer On Death Form online today.

A Transfer On Death (TOD) designation, such as the Dreyfus Transfer On Death Form, often streamlines the transfer of assets compared to a will. With a TOD, assets pass directly to beneficiaries outside of probate, making the process quicker and more efficient. While a will is also important for comprehensive estate planning, combining both tools can provide clarity and speed. It’s recommended to consult with an estate planning advisor to determine the best approach for your situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.